The mining industry can cut its emissions by electrifying and finding efficiencies— but that will take time, especially at remote mines.

This the second Insight in our series on heavy industry.

How can an industry take from the ground without adding to the atmosphere? That is just one of the challenges facing the mining industry as it plans its transition to net zero.

Canada’s mines can be examined from many angles. Among other things, mines produce essential inputs for clean technologies, generate jobs and revenue, and pose a host of environmental and social challenges. Today’s Insight explores only one dimension of the Canadian mining industry: where its emissions come from and how they can be reduced.

So far, more mining has meant more emissions

According to the definition in Canada’s national emissions inventory, mining refers to the extraction of all metal and mineral products except for fossil fuels. It encompasses more than 100 facilities that mine dozens of materials at sites on and under the ground across the country.

Mining is one of the seven sub-sectors of heavy industry, and it is the only one whose emissions have risen since 2005. Overall, mining emissions rose three megatonnes, or 36 per cent, between 2005 and 2022.

It is possible to explain this increase by looking at three key drivers of emissions: economic activity, energy intensity, and emissions intensity.

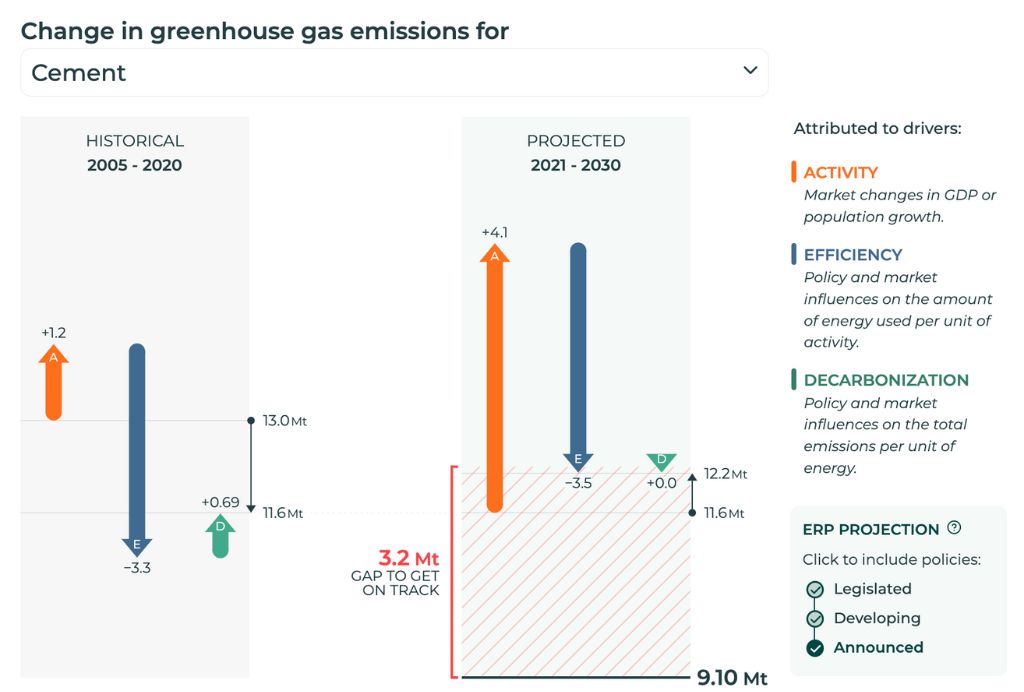

Figure 1 breaks down the impact of these drivers on the mining industry. Clicking on the historical button in the figure, mining emissions are higher largely because mining operations are more energy intensive, per unit of GDP, than they were in 2005.

One reason for this trend may be that there are now fewer accessible, high-quality ores, so mining operations are increasingly extending deeper underground, into more remote areas, or both. The deeper or more remote the mine, the more energy it expends.

A second driver of mining emissions is economic activity. The mining industry has grown since 2005, putting upward pressure on emissions.

On the bright side, Figure 1 also shows that the mining industry has reduced its emissions intensity per unit of energy, mostly by switching to less carbon-intensive fuels. Between 2005 and 2022, mines reduced their consumption of coal and petcoke by 52 per cent, and cut heavy fuel oil use by 43 per cent.

However, mines largely replaced these products with other fossil fuels. Between 2005 and 2022, the mining industry nearly tripled its gas consumption. Two fossil fuels, diesel and gas, accounted for 59 per cent of the energy used in the mining industry in 2022.

Meanwhile, though mines now use more electricity in absolute terms, electricity represents a smaller share of their energy mix, dropping from 37 per cent in 2005 to 33 per cent in 2022. That share needs to increase significantly for the mining industry to decarbonize.

Most mining emissions have electric solutions

Like much of Canada’s economy, a net-zero mining industry will run largely on electricity.

Mines generate most of their emissions by combusting fossil fuels to power equipment and to heat and cool the mine’s site, materials, and workers. All these emissions have electric solutions. Mines can eliminate most of their equipment and transportation emissions with electric drills, haulers, personnel carriers, and more, and meet most of their temperature control needs with industrial heat pumps.

The switch to electricity offers valuable co-benefits. By replacing equipment that runs on fuels like diesel, electric equipment will significantly reduce the amount of ventilation needed at mines, protecting workers’ health and cutting operating costs at the same time.

The expected impact of these changes is visible in the projected drivers tab of Figure 1. Under the climate policies in Canada’s 2030 Emissions Reduction Plan, emissions intensity and efficiency improvements will drive nearly three megatonnes of emissions reductions in the mining industry in 2030. Electrification contributes to both drivers, since it cuts the emissions intensity of fuels and reduces total energy needs.

This transition to electrified mining is already underway. Canada’s first all-electric mining operation opened in 2019, and several other mines have since transitioned off fossil fuels.

It is possible to fully decarbonize mining, but it will take time

Though the solutions to mining emissions are within sight, there are some hurdles in their way.

Like other sectors that plan to electrify, the mining industry needs a bigger, cleaner, and smarter electricity grid. A case study of one Australian mine found that electrification could reduce its energy needs by up to 49 per cent, but would require between two and three times more electricity. On top of the extra generation they require, new mines, and potentially existing ones, will need new or expanded transmission and distribution systems. It will take time to construct that infrastructure, especially if it is to be built in a way that respects Indigenous rights and title, and ecologically sensitive areas.

For Canada’s dozen or so off-grid mines, electrification is even more challenging. Not only is it harder to connect these mines to the grid; renewables also work less well in the northern regions where most remote mines are located. These facilities will likely need a mix of solutions to decarbonize, including renewables, storage, and potentially biofuels, geothermal or even small modular reactors.

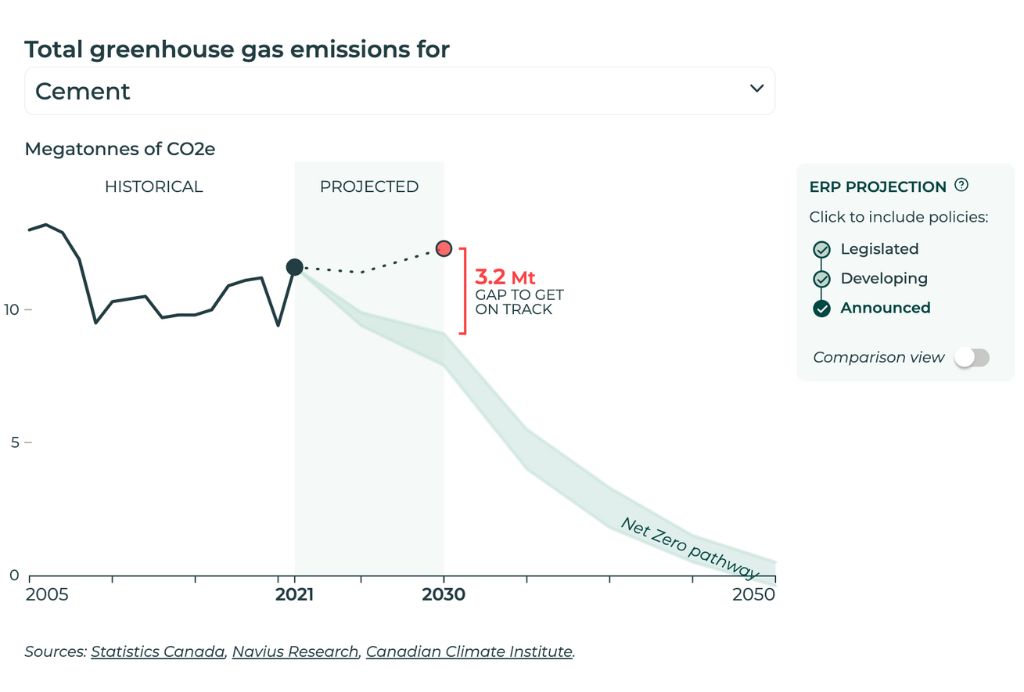

Mining companies’ exposure to fluctuating commodity prices can make them cautious about undertaking large new capital investments. So while electrification can offer cost savings in the long-term, the mining industry may in some cases need targeted support to absorb the upfront costs. Developing the infrastructure necessary to support their electrification will also take time. As Figure 2 illustrates, a net-zero-compliant mining industry is likely to accelerate its emissions reductions in the mid-2030s to early 2040s.

Mining can embody clean growth while driving it

Three categories of policy can keep the mining sector moving along its net zero pathway.

The first is industrial carbon pricing. Mining is a classic example of an industry with high emissions intensity and high exposure to international trade. Canada’s carbon pricing systems have been designed to incentivize these industries to decarbonize while protecting them from competitors in jurisdictions with weaker climate policy.

Governments also play an important role supporting innovation in the mining industry, by funding related industrial research and development, conducting original research, and supporting the development of industry standards that reward high environmental performance.

Finally, governments can continue to support mining electrification and efficiency in targeted ways. For example, government programming has helped deploy renewables at Northern mines, and mines are among the industries that can apply for public funds for energy audits.

Canada is uniquely positioned to be a global leader in low-carbon mining. Investors and buyers are increasingly scrutinizing operational emissions, so the country cannot focus simply on extracting minerals and materials. Leadership requires that Canada’s mines not only contribute to clean growth, but that they model it.

Ross Linden-Fraser is a Senior Research Associate at the Canadian Climate Institute.