More than 70 major decarbonization projects stand to gain directly from industrial carbon pricing—and some could be at risk without these systems.

Industrial carbon pricing is Canada’s single-most important climate policy. Its importance rests not only on its emissions-reducing potential—greater than that of any other policy—but also because of the way that industrial carbon pricing helps attract investment for clean industrial projects.

Industrial carbon pricing is not just a stick, it’s a carrot

It’s well established that industrial carbon pricing functions as a stick by pricing industrial pollution, but it also works as a carrot. That’s because industrial carbon pricing—also known as large-emitter trading systems—creates credit markets where facilities can earn returns from their emissions reductions. Facilities that are highly emissions-intensive buy credits on these markets to cover their excess emissions, while facilities that reduce their emissions can generate credits for their high performance that they can sell for cash. In this way, large-emitter trading systems can use the prospect of credits to attract investment into Canada.

These credits are an important way for facilities to recoup the high costs of emissions reducing projects, especially if the projects wouldn’t earn much revenue on their own. For example, carbon capture projects are capital-intensive to construct and resource-intensive to operate, but their product is a gas that has little commercial value—except if there is a price on carbon. By making emissions reductions eligible for credits, large-emitter trading systems provide CCUS projects with revenue streams that make them viable.

This approach also diminishes the need for subsidies. Other climate policies can’t offer the same cost-effective returns for emissions reductions. The federal investment tax credit for carbon capture, for example, would cover up to half of the capital costs of a project, but wouldn’t provide support for the operating costs, which are high. Credits earned in large-emitter trading markets would help projects to help cover these costs, all without putting a burden on the taxpayer.

Companies are investing billions on the assumption of a carbon price

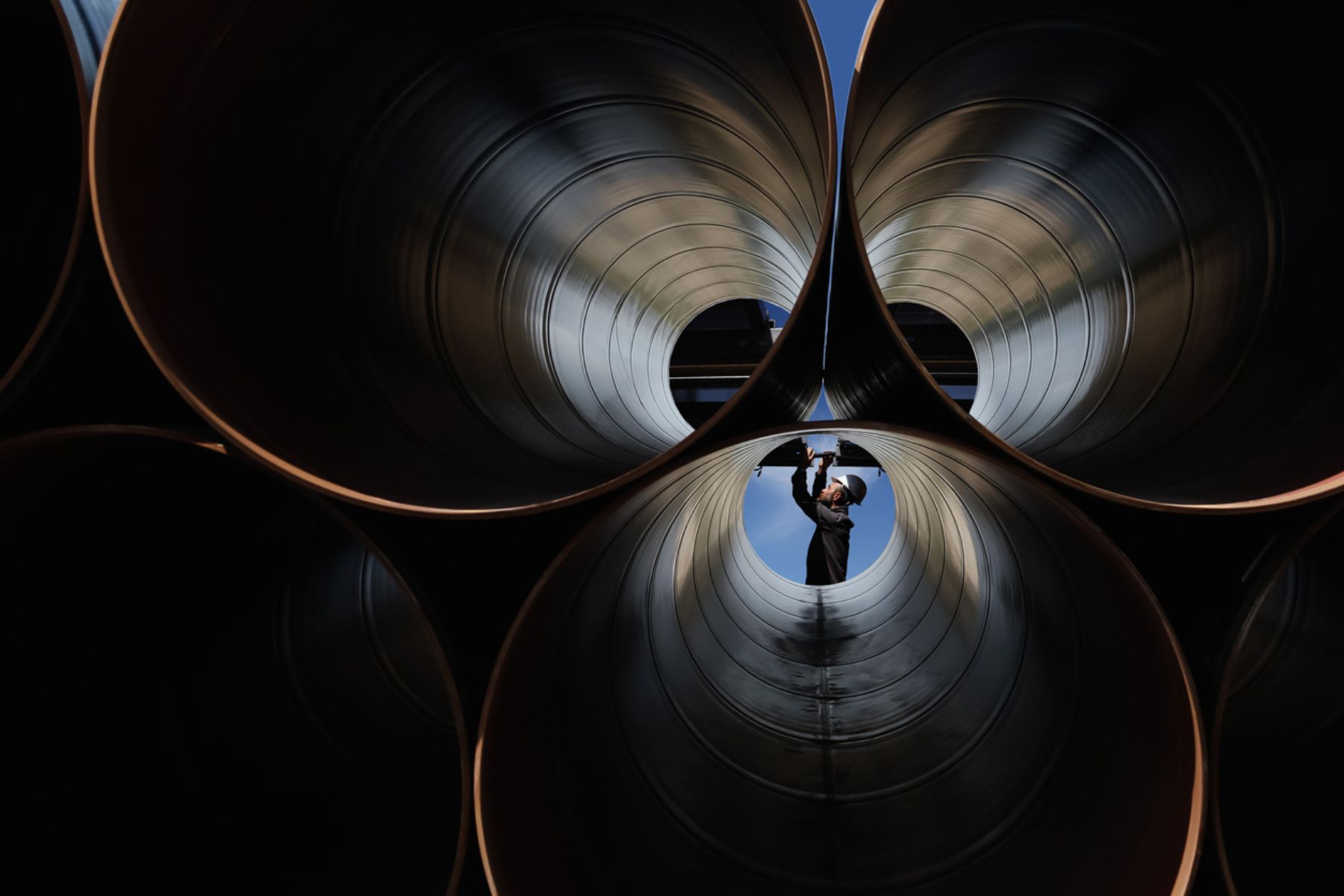

There are already billions of dollars of low-carbon investments across Canada that are banking on the existence of a carbon price. According to the Climate Institute’s research, this includes more than 70 projects in industrial and natural resource sectors with a combined value of more than $57 billion. These emissions-reducing projects would generate performance credits that could be sold in large-emitter trading markets.

These investments include carbon capture installations for oil and gas and heavy industry, decarbonization projects at steel plants and pulp mills, and renewable energy projects in Alberta (the one province where they can earn saleable performance credits and offsets).

Existing facilities stand to gain from large-emitter trading systems, too. Firms that have already completed emissions-reducing projects, such as the Quest carbon capture facility, are earning credits from large-emitter systems that help to cover the investments they’ve already made.

There are big risks to cancelling industrial carbon pricing

As 440 Megatonnes has shown previously, there are billions of dollars in assets that would be at risk if industrial carbon pricing systems were removed. The greatest direct risk is to the credits that companies already hold—amounting to $5 billion in Alberta alone—but investors have made many other decisions with the assumption of an industrial price on carbon, and they might change their minds in the absence of those policies.

One thing is clear: investors have put many billions of dollars on the table to reduce Canada’s emissions, and existing policies have helped make those investments happen. Industrial carbon pricing will help attract the capital to build a cleaner, more competitive Canadian economy—as long as it stays in place.

Ross Linden-Fraser is a Research Lead at the Canadian Climate Institute.